Do you need to pay tax for house letting in the UK? How do you calculate the tax?

Answers (1)

The quick answer is yes if you make profit from your rental income. However, you don't need to pay tax if you let one of the rooms in your house and the rental income is less than £4,250.

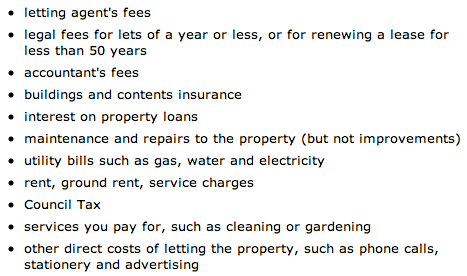

You pay tax on your rental net profit instead of rental income. i.e. Net profit = rental income - allowable expenses. The following expenses are considered as allowable expenses that you can deduct from letting income: source:www.direct.gov.uk/en/MoneyTaxAndBenefits/Taxes/TaxOnProperty

source:www.direct.gov.uk/en/MoneyTaxAndBenefits/Taxes/TaxOnProperty

Personal expenses or capital costs (e.g. furniture, the property) are not allowable expenses, so you can not deduct from your rental income. However, if you let the property with furniture, you can claim allowance for 'wear and tear', which is 10 percent of the net rent. Alternatively, you can claim 'renewals' allowance which covers the cost of replacing equipment or furniture. Once you choose one way to deduct, you have to stick with that. You may also find advise regarding expenses on this site helpful.

If your rental profit is less than £2500 and you pay your tax via PAYE, you need to send form P810 to HM Revenues & Customs. In other cases, you need to fill a self-assessment form. Read more here.

For detailed advice, you can also check this site - www.rla.org.uk/taxCentre/questions.shtml

Related Questions